nebraska inheritance tax worksheet 2021

Her estate is worth 250000. Nebraska Tax Application and Return for Mechanical Amusement Device 052018 54.

402 475-7091 Toll Free 800 927-0117 Fax 402 475-7098.

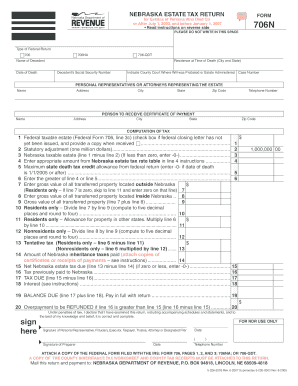

. NF96-236 Nebraska Inheritance and Estate Taxes. An inheritance tax worksheet must be completed essentially an inheritance tax return and an effort made to. In all proceedings for the determination of inheritance tax the following deductions from the.

Once the amount of the. In some estates this may require appraisals. The Nebraska inheritance tax applies to all property including life insurance proceeds paid to the estate which passes by will or intestacy.

Proceedings for determination of. Nebraska Inheritance Tax Worksheet. By JD Aiken 1996 The Nebraska inheritance tax is imposed on all property inherited.

Practice worksheets to help your child to learn their basic math facts. Nebraska Inheritance Tax Worksheet 2021. Form 6 Ordering Other Years Income Tax Forms Select Year2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax.

Nebraska Inheritance Tax Worksheet Instructions. Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax. See all our our 3rd grade worksheets and educational activities.

Practice your Addition Subtraction Mutliplication and Division - self-marking Online exercises. Close relatives pay 1 tax after 40000. Fl Capital Gains Tax Rate.

Math for Week of June 14. Patricias husband inherits 125000. Once the amount of the inheritance tax is.

Ceyron is Versatile Proactive Web Designer with alistarbot. Suite 200 Lincoln NE. On a statewide basis inheritance tax collections in Nebraska have ranged from a 189 to 733 million since 1993 337 to 745 million if adjusted for inflation into 2020 dollars.

Patricias nephew inherits 15000. It is a free printable worksheet. Certificate of mailing annual budget reporting forms.

Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other. Design themes for creatives and lifestyle bloggers. Nebraska inheritance tax is computed on the fair.

Her estate is worth 250000. Skip Counting by 10s. Nebraska Tobacco Products Tax Return for Products Other than Cigarettes 122019 56.

Our free math worksheets cover the full range of elementary school math skills from numbers and counting through fractions decimals word. Test your math skills. The inheritance tax applies to all property including life insurance proceeds paid to the estate which passes by will or intestacy.

Patricias long-time friend inherits. Property at the date of death. Up to 25 cash back Close relatives pay 1 tax after 40000.

Math for Week of July 5. Nebraska State Bar Association 635 S. Learn more 2004 Instructions For Form.

Patricias son inherits 50000.

Fillable Online Revenue Ne Nebraska Estate Tax Return Form 706n Fax Email Print Pdffiller

What Are Inheritance Taxes Turbotax Tax Tips Videos

Death And Taxes Nebraska S Inheritance Tax

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

What Is Inheritance Tax Who Pays An Inheritance Tax Estate Planning

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Nebraska Inheritance Tax Worksheet 2021 Form Fill Out And Sign Printable Pdf Template Signnow

Nebraska Forms Nebraska Department Of Revenue

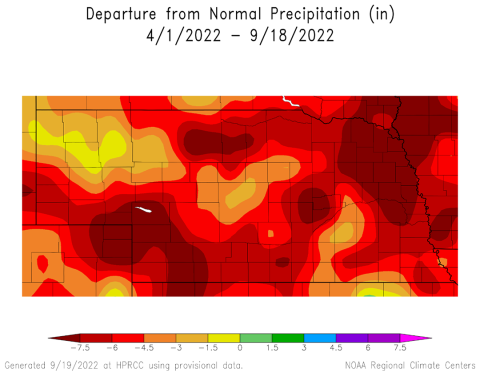

Cropwatch University Of Nebraska Lincoln

Nebraska Inheritance Tax Worksheet Form 500 Fill Online Printable Fillable Blank Pdffiller

Form 6 Nebraska Fill Online Printable Fillable Blank Pdffiller

Death And Taxes Nebraska S Inheritance Tax

Nebraska Inheritance Tax Worksheet Form Fill Out Sign Online Dochub

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Inheritance Tax Worksheet Form 500 Fill Out Sign Online Dochub

Nebraska Income Tax Ne State Tax Calculator Community Tax

Is There An Inheritance Tax In Kansas Estate Planning Attorneys In Missouri And Kansas

:max_bytes(150000):strip_icc():gifv()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)